CBAM Reporting and Compliance Services in Indonesia

- End-to-end CBAM consultancy in Indonesia

- Reduce Carbon tax by 50%

- CBAM-proof steel export

Book your consultation at

Globally Trusted for CBAM Reporting

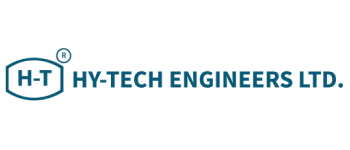

Streamline Your Carbon Accounting on a single platform

Simplifying carbon accounting for Scope 1, Scope 2 and Scope 3 emissions at one place. Our smart software is aligned with global standards such as the GHG Protocol, ISO 14064, and the EU’s Carbon Border Adjustment Mechanism (CBAM).

What is CBAM?

The Carbon Border Adjustment Mechanism (CBAM) is the European Union’s new carbon taxation and reporting system applied to carbon-intensive products entering the EU market.

It requires exporters to report the embedded carbon emissions of their products to ensure they match the EU’s climate standards.

Why CBAM Matters for Indonesian Businesses?

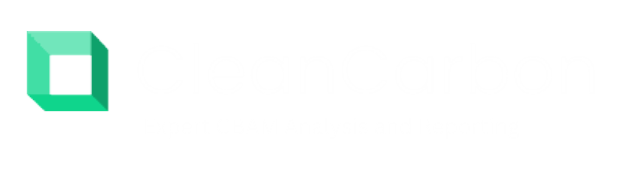

Around 6.2% of the total Indonesian exports to Europe are subjected to CBAM, and the most impacted sectors are iron & steel and fertilizers. CBAM impacts iron and steel trade with the EU worth US$941.05 million in Indonesia.

For CBAM Indonesian exporters, CBAM is especially important because:

- Many Indonesian industries (steel, aluminium, cement, fertilizers, hydrogen, electricity) fall under CBAM’s transitional phase.

- Importers in the EU must submit quarterly CBAM reports — and they rely on suppliers in Indonesia to provide accurate emissions data.

- Companies that fail to provide verified carbon data risk losing EU buyers, facing costly default values, or experiencing shipment delays.

- CBAM is not just a regulatory shift — it is becoming a competitive advantage for Indonesian exporters who can prove low-carbon, traceable production.

Why CBAM Reporting in Indonesia?

Any Indonesian company exporting CBAM-covered products to the EU must provide emissions data to EU importers. This includes:

Industries currently covered by CBAM:

Iron and Steel

Aluminium

Fertilizers

Cement

Electricity

Hydrogen

You need CBAM reporting if you are:

- An Indonesian manufacturer, processing unit, or exporter shipping CBAM-regulated goods to EU customers.

- An EU importer sourcing these products from Indonesia.

- Companies that fail to provide verified carbon data risk losing EU buyers, facing costly default values, or experiencing shipment delays.

Even if you export small quantities, CBAM reporting is mandatory during the transitional phase.

Our CBAM Services for Indonesia Companies

Clean Carbon provides complete end-to-end CBAM support tailored for Indonesian manufacturers and exporters, including:

Product Carbon Footprint (PCF) Calculation

- Facility-level emissions measurement

- Product-specific embedded emissions

- Fuel, energy, and process emissions accounting

- Calculation aligned with the EU CBAM methodology

CBAM Data Collection & Documentation

- Activity data gathering (materials, fuels, energy)

- Verification readiness

- Evidence packaging for EU importers

Deep regulatory knowledge

- Quarterly CBAM-aligned reporting

- Help in filling data gaps

- Templates, formats, and documentation

EU Importer Support

We help streamline data transfer between Indonesian suppliers and EU importers:

- Importer–supplier coordination

- Structured CBAM files and emission reports

- Support during importer submissions

CBAM Training for Indonesian Teams

- Workshops on CBAM rules

- Data collection training

- GHG accounting basics

Ongoing Monitoring & Compliance

- Annual updates

- Process optimization

- Continuous emission reduction guidance

How We Help with CBAM Compliance and Reporting?

Clean Carbon ensures that Indonesian exporters are CBAM-ready through a structured step-by-step process:

01

Assess Your Factory & Product Scope

We identify which production lines and materials fall under CBAM.

02

Collect Facility and Process Data

Energy consumption, fuels, raw materials, process emissions, production volumes, etc.

03

Calculate Emissions Using EU-Certified Methods

We apply CBAM-compliant methodologies such as:

- Direct and indirect emissions

- Default vs. actual data

- System boundaries aligned with EU standards

04

Prepare CBAM Reports for EU Importers

We convert your factory data into a complete CBAM report package.

05

Ongoing Compliance Support

As rules evolve, we ensure that your reporting remains accurate and up-to-date.

06

Guidance for Future Verification

From 2026, CBAM will require third-party verification — we help you get ready early.

Why Choose Clean Carbon for CBAM in Indonesia?

100% CBAM-Focused

We specialize exclusively in CBAM, carbon reporting, and EU sustainability regulations.

Seamless Supplier–Importer Coordination

We ensure smooth communication between Indonesian exporters and EU importers.

100% CBAM-Focused

We specialize exclusively in CBAM, carbon reporting, and EU sustainability regulations.

Fast Turnaround

Get CBAM-ready in days, not months.

Accurate & Audit-Ready Calculations

Our methods follow the latest EC guidelines, ISO standards, and GHG Protocol.

Trusted by Exporters Across Asia

Clean Carbon is preferred by suppliers and importers who want reliable CBAM reporting without complexity.

Frequently Asked Questions (CBAM Indonesia FAQs)

01 Is CBAM mandatory for Indonesian companies?

Your EU buyer will use default values, which are usually higher than actual emissions. This makes your product appear more carbon-intensive — reducing competitiveness.

02 What happens if I don’t provide CBAM emissions data?

Your EU buyer will use default values, which are usually higher than actual emissions.

This makes your product appear more carbon-intensive — reducing competitiveness.

03 Does CBAM apply during the transitional phase (2023–2025)?

Yes. Reporting is required, but no payment of carbon tax yet.

Accurate reporting is important to avoid penalties or disrupted shipments.

04 What emissions data do I need to provide?

Typically:

- Fuel consumption

- Electricity use

- Production volumes

- Process emissions

- Raw material data

We help you collect everything correctly.

05 Will CBAM require third-party verification?

Yes — starting 2026. Clean Carbon prepares your data to be verification-ready.

06 Is CBAM only for large exporters?

No. Even small shipments to the EU must include emissions data.

Get Expert CBAM Support in Indonesia

Clean Carbon ensures your CBAM reporting is accurate, compliant, and accepted by EU importers — without the usual complexity.

Latest Blogs

CBAM reporting tools act as a catalyst in ensuring accurate CBAM compliance for exporters, prevention of inflated carbon tax, and...

CBAM reporting for Indian exporters are changing so fast and it is very important for them to be fully ready...

The most carbon-intensive products and items are cbam sectors during the ongoing mandatory reporting phase. Here is a look at...