Effortless CBAM Reporting & Compliance

We provide tailored CBAM solutions:

- Expert CBAM Reporting

- Verified and Validated report

- CBAM Consulting & software

- Reduce your Carbon Tax

Book your consultation at

Trusted by 200+ Exporters for CBAM Advisory Worldwide

Growing network of exporters across Iron and Steel, Cement, Aluminium, and more.

Save 30% on CBAM reporting

- Too Many Rules:

Changing EU laws make trade confusing.

- High Paperwork Costs:

Manual reporting takes time and money.

- Delay Risks:

Missing rules can delay shipments and cause fines.

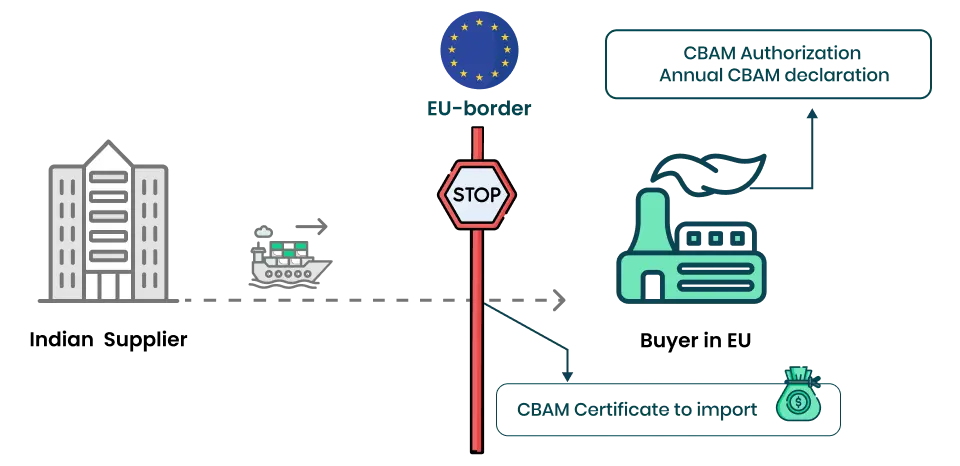

EU Carbon Border Adjustment Mechanism simplified

Trusted by

the Ministry of Commerce and Industry

Official CBAM Partner of SEPC and EEPC India

founder's Message

Step-by-step CBAM Services & solution, So You Can Focus on Business

Expert CBAM Consulting

and CBAM Advisory

- CBAM experts for your team

- Step-by-step support

- Easy, stress-free compliance

- Smart guidance for decisions

Lower Cost and Proven Savings

- Cut CBAM costs by up to 30%

- Start saving right away

- Tailored solutions for your business

- Affordable and easy compliance

Rapid and Accurate Compliance Reporting

- Get EU-ready reports fast (XML & Excel)

- Accurate and on-time reporting

- Keep your exports running smoothly

Trusted by Global Industry Leaders

- Trusted by 200+ manufacturers

- Used by leaders in automotive, machinery & engineering

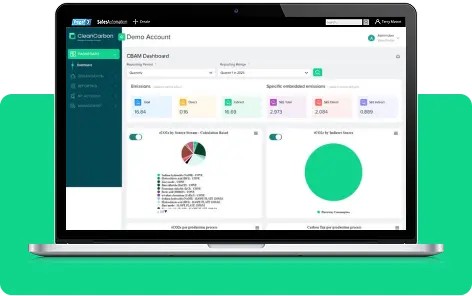

Automated CBAM Reporting

- Smooth integration with your ERP

- Less manual work, fewer errors

- Easy emissions tracking and reporting

- Sectors we cover

CBAM consulting and Compliance for all Mandated Sectors

Iron & Steel

Tractors

Foundry

Fasteners

Aluminium

- Our CBAM Services

Smarter Way to Handle

CBAM with comprehensive strategy

Most Affordable Pricing

Best-in-class value for exporters of all sizes

Complete Emissions Coverage

Accurate Scope 1, 2, and 3 supply chain emissions analysis

EU-Ready Reporting

Compliant reports in XML and Excel formats

Real-Time Compliance Insights

Dashboards for instant visibility of emissions profile

Carbon Audit Report Readiness

Field support to ensure audit-readiness

Verified & Validated Reports

Reviewed by CBAM specialists to ensure accuracy

End-to-End Automation

ERP-integrated tools for automatic emissions tracking

Speak to a CBAM Expert Now

Stand out in Climate-focused markets

Sonalika Tractors Retains EU Market Share with Timely CBAM Compliance

Challenge

Convincing suppliers to share Scope 1, 2, and 3 emissions data was challenging.

Solution

Deployed intuitive platforms integrated with Sonalika’s systems.

Outcome

Achieved high supplier participation through engaging demos

Grik Metal India’s timely CBAM Compliance Saves 35% on CarbonTax

Challenge

Grik Metal needed a solution to ensure EU-compliant reporting

Solution

Generated compliant XML and Excel reports, validated by CBAM xperts

Outcome

Ensured 100% on-time submission of EU-compliant reports

Escorts Kubota: Timely CBAM Compliance Despite Hundreds of Suppliers & Data Points

Challenge

Suppliers needed a quick, accessible way to input emissions data.

Solution

Provided suppliers with user-friendly tools integrated into EKL’s systems.

Outcome

Engaged 35 suppliers successfully, with 100% data submission.

Jamshedpur chlorochem expands eu market share with timely cbam compliance

Challenge

Maintain GDPR-compliant data handling.

Solution

Generated validated XML and Excel reports compliant with EU CBAM standards.

Outcome

Achieved 100% on-time submission of EU-compliant reports

Jindal Aluminium reduces CBAM tax by 40% through timely reporting

Challenge

Third-party validated reports for credibility with EU regulators

Solution

Custom dashboards provided Jindal with instant visibility into their emissions profile

Outcome

Passed EU audits with zero discrepancies

Credible and certified sustainability reporting platform

We closely work with the Ministry of Commerce and Industries to empower sustainable change. We launched a carbon cell with SEPC under the Ministry of Commerce and Industries to empower EU CBAM compliance and carbon accounting.

SEBI approved for

ESG

Certification

Cleancarbon.ai, is the Securities and Exchange Board of India (SEBI) approved carbon management platform to operate as an Environmental, Social and Governance (ESG) Rating Provider under Category II (IN/ERP/Category-II/0019). SEBI’s official data-driven ESG rating provider.

ISO 14001:2015

Certification

ISO 14001:2015 (Environment Management System) certified platform to validate and verify environmental, carbon and sustainability information, along with ensuring GHG inventories, carbon credits, CBAM reporting, and ESG disclosures.

ISO 9001:2015

Certification

ISO 14065:2020

Certification

ISO 14065:2020 (General principles and requirements for bodies validating and verifying environmental information) certified and registered company to conduct validation and verification of environmental, carbon, sustainability information, along with GHG inventories, carbon credits, CBAM reporting, and ESG disclosures.

ISO 27001:2022

Certification

ISO 27001:2022 (Information Security Management Systems) consulting & development services in it and development of environmental software platforms and products, including cbam and gri ,ghg, brsr and other frameworks.

ISO/IEC 17029:2019

Certification

ISO 14064-1:2018

Certification

ISO 14064-1:2018

(Greenhouse gases – Part 1: Specification with guidance at the organization level for

quantification and reporting of greenhouse gas emissions and removals) certified platform to validate and verify environmental, climate, and sustainability information, including greenhouse gas emissions, embedded emissions, carbon data, activity data, and calculation methodologies, for regulatory and compliance frameworks such as the eu carbon border adjustment mechanism (cbam), iso 14064 series, and other applicable international climate and environmental regulations, in accordance with iso/iec 17029 principles of impartiality and independence.

Mr. Nilesh Bhattad featured in CBAM podcasts on ET Now, Mint and ABP Live

Why trust CleanCarbon for the CBAM solution?

– Group Head Safety and Environment, Jindal Aluminium

– Yerik International

– BDM, SUNRISE MULTI TECH FASTENERS PVT. LTD.

Partnering with CleanCarbon.ai revolutionized our EU export process by providing expert CBAM compliance guidance. They clarified our carbon footprint, ensured accurate documentation, and inspired confidence in meeting international standards. We highly recommend them for navigating carbon border regulations efficiently and sustainably.

– Representative

By automating our CBAM reporting and streamlining emissions tracking, we not only cut compliance costs by 35% but also avoided hefty carbon taxes—delivering direct savings and ensuring smooth access to EU markets.

– Representative

– Representative

“CleanCarbon.ai’s solutions have not only enabled us to meet CBAM compliance but have also laid out a clear route toward sustainable and profitable operations. Their expertise and tools have been essential for the success of our Rebar Mill project.”

– Representative

“CleanCarbon.ai’s innovative solutions and dedicated support have been instrumental in our journey to CBAM compliance. They have enabled us to align with global sustainability standards while staying competitive.”

– Representative

CleanCarbon.ai simplified our CBAM compliance, ensuring full regulatory adherence while achieving cost savings. Their expert solutions enhanced our reputation as a trusted ferrochrome supplier in the EU and aligned with our sustainability goals. We highly recommend CleanCarbon.ai for exporters seeking reliable and affordable compliance assistance.

– Representative

– Representative

– Representative

– Representative

– Representative

CleanCarbon.ai helped us seamlessly navigate CBAM compliance with their automated, expert-led solutions. Their support enabled us to maintain focus on our core excellence in manufacturing high-purity zinc, solder, and aluminium wires—while ensuring EU regulatory adherence, operational efficiency, and sustainability alignment.

– Representative

CleanCarbon.ai seamlessly supported CBAM compliance at Newzel Industries, enabling us to meet EU regulations confidently. Their automated solutions ensured compliance, cost-efficiency, and sustainability without disrupting operations, while we focused on delivering top-quality ISO PED 2015-certified steel products, including plates, pipes, fittings, and flanges.

– Representative

CleanCarbon.ai simplified our CBAM compliance journey with precision and ease. Their automated, expert-driven solutions allowed us to meet stringent EU regulations—while enabling us to stay focused on crafting high-quality stainless steel fine wires with ongoing commitment to quality, timely delivery, and process excellence.

Book your first free CBAM consulting now

Why Choose CleanCarbon.ai

Over Traditional Consultancy?

Feature

Automation Level

Reporting Accuracy

Cost Efficiency

Scalability

Industry-specific Support

Traditional Consultancy

Manual-heavy

Prone to human error

High cost

Limited and complex

Generalized approach

CleanCarbon.ai

Fully automated

High precision with validation

Affordable prices

Tailored scalability

Industry-specific expert CBAM advisory

EU-Compliant Reporting,

No Guesswork

- Accredited

Third-party validations and EU regulatory endorsements.

- Trusted Globally

Over 200 exporters successfully compliant.

- Security Assured

Robust data protection adhering to GDPR standards.

Speak to a CBAM Expert Now

Stay in the EU market, now and future

FAQ

What is CBAM reporting and why is it important for Indian exporters?

The Carbon Border Adjustment Mechanism (CBAM) is a regulatory framework introduced by the European Union (EU) to ensure that imported goods reflect their carbon emissions, similar to goods produced within the EU.

For Indian exporters, CBAM reporting is crucial because it determines their carbon footprint transparency and compliance eligibility when exporting to the EU. Accurate CBAM reporting helps avoid penalties, ensures market access, and demonstrates commitment to sustainable business practices.

How does CleanCarbon help companies with CBAM compliance?

CleanCarbon.ai provides end-to-end CBAM compliance solutions, including data collection, emission calculation, report automation, and submission support. Our platform simplifies complex regulatory requirements, ensuring exporters remain compliant, audit-ready, and cost-efficient while focusing on their core operations.

What are the key steps involved in CBAM reporting for Indian exporters?

The CBAM reporting process typically includes:

- Identifying CBAM-covered products being exported to the EU.

- Collecting emission data from production and supply chains.

- Calculating embedded emissions using approved methodologies.

- Preparing quarterly CBAM reports as per EU guidelines.

- Submitting reports through the EU’s CBAM portal or via authorized representatives.

CleanCarbon assists at every stage to ensure accuracy and compliance.

How does CBAM compliance affect international trade with the EU?

CBAM compliance directly impacts market access and competitiveness for exporters. Non-compliance may lead to financial penalties, delayed shipments, or restricted entry into EU markets. By maintaining CBAM compliance, Indian exporters can build stronger trust with EU buyers, enhance brand reputation, and contribute to global decarbonization goals.

What are the benefits of working with CBAM consulting experts in India?

Partnering with CBAM experts like CleanCarbon offers multiple benefits:

- In-depth understanding of EU regulations and updates.

- Accurate emission calculation and report validation.

- Automation tools that save time and reduce reporting errors.

- Continuous guidance to stay compliant as rules evolve.

This expertise helps exporters avoid risks and maintain long-term trade sustainability.

Does CleanCarbon offer customized CBAM reporting solutions for different exporters?

Yes. CleanCarbon.ai offers tailored CBAM solutions designed to meet the unique operational and data needs of each exporter. Whether you’re a small manufacturer or a large industrial exporter, our system adapts to your processes, ensuring seamless compliance and accurate reporting.

Is CBAM reporting mandatory for Indian exporters trading with EU countries?

Yes, CBAM reporting is mandatory for exporters shipping CBAM-regulated goods (such as iron, steel, aluminum, cement, fertilizers, electricity, and hydrogen) to the European Union. Since October 2023, exporters must submit quarterly CBAM reports during the transitional phase, with carbon costs applying from January 2026.

Latest Article & Blog

CBAM reporting tools act as a catalyst in ensuring accurate CBAM compliance for exporters, prevention of inflated carbon tax, and...

CBAM reporting for Indian exporters are changing so fast and it is very important for them to be fully ready...

The most carbon-intensive products and items are cbam sectors during the ongoing mandatory reporting phase. Here is a look at...