CBAM

The full form of Cbam is Carbon Border Adjustment Mechanism. This policy is introduced by the European Union (EU) to reduce carbon emissions and promote fair trade. Its main goal is to ensure that products imported into the EU follow the same carbon emission standards as products manufactured within the EU.

What is the Meaning of CBAM?

The carbon border adjustment mechanism (CBAM) is the world’s first carbon tax, which was introduced by the European Union Commission, to reduce carbon emissions and push for global decarbonisation. In simpler terms, CBAM is the EU’s tool to put a fair price on the carbon emitted during the production of goods outside the EU that are meant to enter the European market.

CBAM EU is designed to promote cleaner industrial production in non-EU countries and prevent carbon leakage, which happens when EU companies shift their production units to other countries with lax climate policy to offshore their emissions.

CBAM is a replica of the European Union’s internal Emissions Trading System (EU ETS) that is meant to restrict and minimise the production of carbon-intensive items. However, EU ETS is not applicable to the countries not part of the European Union, which means products from other nations without a similar carbon tax could disrupt the EU market at cheaper prices and create price disparity. Hence, CBAM was introduced to ensure level-playing field and remove unfair competition.

CBAM’s trial phase (Transitional Phase) started on 1 October 2023, meant to act as a pilot learning period for all stakeholders in iron and steel, aluminium, hydrogen, cement, fertilisers, and electricity sectors. Moreover, eu carbon border adjustment mechanism reporting will become mandatory 1 January 2026.

Why does CBAM matter?

Preventing Carbon Leakage: Carbon leakage is when industries relocate to regions with weaker environmental regulations to avoid paying for carbon emissions. CBAM aims to prevent this by ensuring that emissions are accounted for, regardless of where goods are produced.

Driving Global Decarbonization: CBAM encourages non-EU countries to adopt more ambitious climate policies and cleaner production methods to avoid the additional cost of importing to the EU market.

Supporting EU industries: It protects EU industries that operate under strict climate regulations from unfair competition from regions with laxer environmental standards.

Why Did the EU Introduce CBAM?

The European Union Commission introduced the CBAM to prevent carbon-leakage, create a level playing field between EU importers and non-EU exporters and push for global decarbonisation under its ‘Fit for 55’ initiative aimed at making EU climate-neutral by 2050 as per the Paris Agreement.

Primary Reasons to Introduce CBAM:

Prevent Carbon Leakage: The top most reason to introduce the CBAM for non-EU exporters is to prevent carbon-leakage or offsetting of emissions to any other countries. eu carbon border adjustment mechanism acts against attempts to compromise in reduction of carbon emissions.

Price Parity: Second objective of CBAM is to create a level-playing field and not result in any kind of price disparity for either EU buyers or suppliers to the EU. It ensures an equal carbon pricing imposed on all players in the European market.

Global Decarbonisation: Through CBAM, EU plans to push for more effective decarbonisation strategies and incentivise cleaner productions across the globe.

What are the sectors covered under the EU CBAM?

Currently, CBAM is applicable only to the most carbon-intensive sectors and products entering the EU market. The most carbon-intensive sectors covered under the CBAM are:

- Cement

- Iron and Steel

- Aluminium

- Fertilisers

- Electricity

- Hydrogen

This focused scope allows for a smoother rollout, with the intention to expand to all sectors covered by the EU ETS by 2030.

How the CBAM Works?

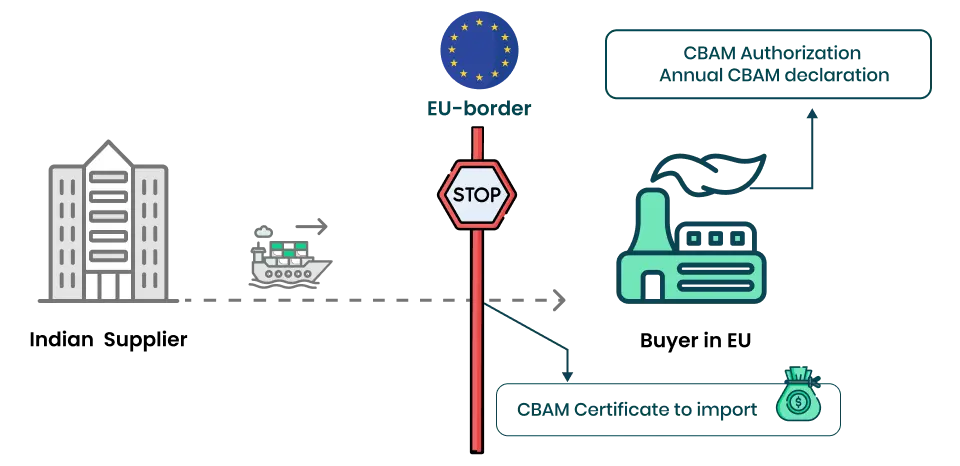

CBAM functions by requiring importers of covered goods to purchase and surrender CBAM certificates.

Here’s a step-by-step breakdown of the process:

- An EU importer/buyer brings goods from a non-EU country into the EU market.

- The importer calculates the embedded direct (and later indirect) greenhouse gas emissions in those goods, following EU methodologies.

- The importer declares the total embedded emissions in their quarterly CBAM report.

- The importer purchases CBAM certificates corresponding to the declared emissions. The price of these certificates is linked to the weekly average auction price of EU ETS allowances.

- The importer surrenders the required number of CBAM certificates to the national authority annually.

- A key feature: If a non-EU producer can prove they have already paid a carbon price for the manufacturing of the imported goods in their home country, the corresponding cost can be fully deducted for the EU importer.

CBAM Implementation Timeline

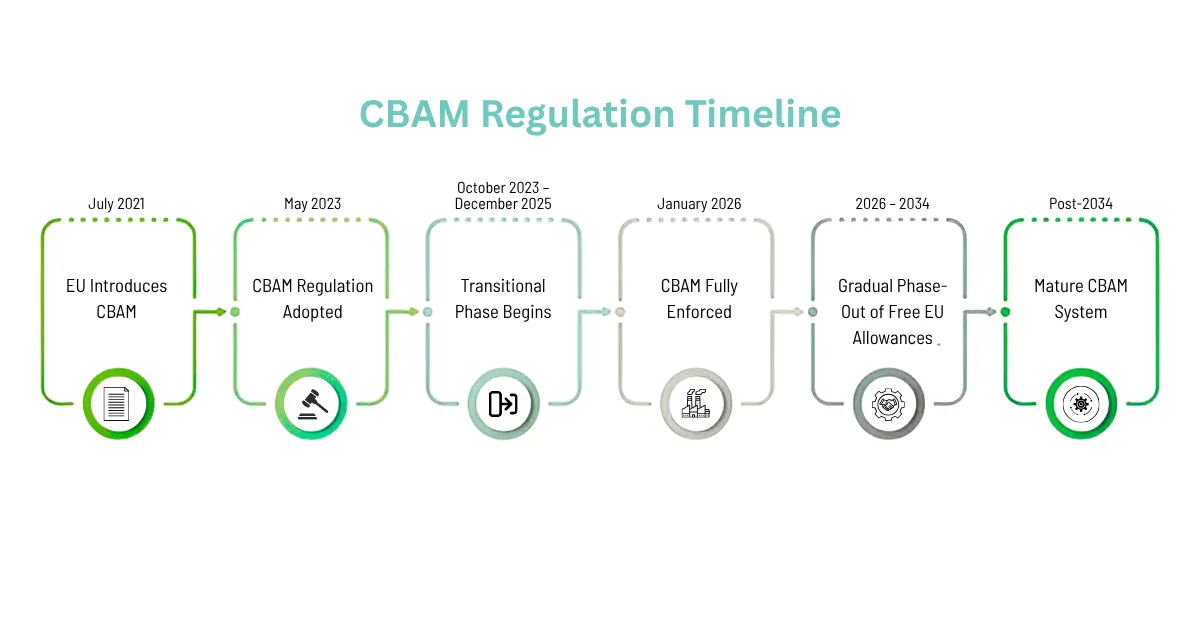

CBAM is being rolled out in two phases:

- Transitional Phase (October 1, 2023 – December 31, 2025)

- Objective: This phase is a pilot learning period for all and data collection and testing of the mechanism will be tested during this period.

- Requirement: Importers must submit quarterly CBAM reports declaring the embedded emissions in their imports. The first report was due by January 31, 2024.

- Financial Cost: No financial payments are required during this phase, only reporting is mandatory.

- Definitive Phase (Starting January 1, 2026) CBAM reporting becomes mandatory.

- Objective: Full implementation of CBAM will be in force. CBAM TAX WILL BE APPLICABLE.

- Requirement: Importers must declare the embedded emissions annually and surrender the corresponding number of CBAM certificates.

- CBAM Tax: CBAM tax will be applicable for all quarterly reports from January 2026. However, the tax calculated will have to be paid only from January 2027.

- Phased Integration: As CBAM is phased in, the free allocation of EU ETS allowances to sectors covered by CBAM will be phased out.

Reporting and Compliance Requirements Under CBAM

Compliance is mandatory and administered by national authorities in each EU member state.

- Who Reports?

The “authorised declarant” – typically the EU importer/buyer of record. - What is Reported?

Total embedded direct emissions (Scope 1) for each product, detailed by production facility and Indirect (Scope 2) emissions along with the precursors emissions data (raw materials used to make another CBAM covered product). - How to Report?

Via the European Commission’s central CBAM Transitional Registry. - Penalties for Non-Compliance:

Failure to report or surrender certificates can result in financial penalties (€10-50 per tonne of unreported CO2e) and potentially other sanctions.

Latest CBAM Reporting Requirements

Who submits a CBAM report?

Under the CBAM reporting requirements from January 2026, only the Authorised CBAM Declarants (ACD), also known as importers or European buyers, are mandated to submit quarterly CBAM reports to the authorities for free circulation of their imported product. An importer which is not a legally Authorised CBAM Declarant can not accept CBAM imports for the EU market. For example, a supplier of a product made of iron and steel from India to Europe has to submit the CBAM report to its buyers quarterly. Subsequently, the buyers will submit these reports to the customs and relevant authorities in the EU to sell their products in the EU market.

In cases where the importer is not based out of the EU, its customs representative must become an ACD and take up the full legal responsibility of CBAM compliance.

CBAM Certificate Price Rules for 2026

- From January 2026, the Commission will calculate CBAM certificate price for each quarter as the quarterly average auction clearing prices under the EU ETS. These prices will be calculated during the first calendar week of every quarter.

- In 2026, the quarterly CBAM certificate price will be calculated.

- The relevant auction platforms shall provide all the required information for calculating the CBAM certificate prices for that quarter.

CBAM Certificate Price Rules for 2027

- From January 1, 2027, the CBAM certificate price will be calculated every calendar week on the basis of the weekly average of EU ETS allowance prices.

- Price of CBAM certificates will apply to all CBAM certificates sold to Authorised CBAM Declarants.

- The Commission will publish all CBAM certificate prices on its official website on the first working day.

- Price of CBAM certificates will be made available only to Authorised CBAM Declarants.

CBAM Report Verification Rules

- EU-approved verifiers must conduct physical site visits at the installation where goods were manufactured.

- In 2026, physical visit at all locations is mandatory. However, from 2027, the verifier may either replace the physical visit with virtual visit or waive off the visit.

- The verifier can waive visit from 2027 only after visiting once in 2026 and it does not compromise the data credibility.

- The physical visit should be carried every two years at least.

- The verifiers must analyse all data and cross-check for any misstatements and inaccuracies in the submitted report. Moreover, the verifier has to apply a risk-based approach to reach any opinion.

- The submission and review of the verification reports will be done using a single electronic temple given by the Commission only.

- The verifiers can apply materiality threshold (Scope of error) by 5% only.

Use of Default Values

- Using default values could increase CBAM tax 5 times.

- Different default values for different countries.

- Extremely high default values to act as punitive measures.

- Additional mark ups of 10 % & 20% on the use of default values.

- No benefits of a low-carbon economy.

- Pressure to change suppliers due to inflated CBAM tax.

- Uncompetitive trade business.

Impact of CBAM on Global Trade

CBAM is poised to reshape global trade dynamics:

- For EU Importers: Increased administrative burden and potential cost increases for covered goods, requiring new due diligence and reporting systems.

- For Non-EU Exporters: Producers in countries without carbon pricing will face a new cost barrier to the EU market, creating a competitive disadvantage unless they decarbonize.

- For Global Supply Chains: Companies worldwide will be incentivised to track and lower the carbon footprint of their products, pushing transparency and green manufacturing up the value chain.

- Geopolitical Tensions: CBAM has been met with concerns from major trading partners who view it as a protectionist measure, potentially leading to trade disputes at the WTO.

Benefits and Challenges of the EU CBAM

Benefits:

- Effective Climate Tool: Directly prevents carbon leakage and ensures global decarbonisation.

- Promotes Innovation: Drives investment in low-carbon technologies globally.

- Global Standard-Setter: Encourages the global adoption of carbon pricing and emissions accounting.

- Fair Competition: Protects EU industries committed to decarbonisation and creates a level playing field for all businesses.

Challenges:

- Administrative Complexity: The reporting and verification requirements are significant for businesses and authorities.

- Trade Friction: Risk of retaliatory measures and disputes with trading partners.

- Methodological Hurdles: Accurately calculating embedded emissions, especially in complex supply chains, is challenging.

- Data Collection: Collecting accurate embedded emissions data is a big challenge as it involves third-party data gathering and maintaining data hygiene.

- Equity Concerns: Potential disproportionate impact on developing economies.

How Businesses Can Prepare for CBAM

Proactive preparation is key to managing CBAM’s impact.

- Conduct a CBAM Assessment: Determine if your imported or exported goods fall under the current or future scope.

- Map Your Supply Chain: Identify all production facilities and their locations to understand your exposure.

- Develop Emissions Accounting Capabilities: Invest in systems to accurately measure and report the embedded carbon in your products.

- Engage with Suppliers: Start conversations with non-EU suppliers about their carbon footprint and emission reporting capabilities.

- Explore Decarbonisation Strategies: Assess opportunities to reduce the embedded emissions of your products through efficiency improvements, fuel switching, and green technology.

- Seek Expert Advice: Consult with sustainability and trade law experts to navigate the complex regulatory landscape.

Future of the eu carbon border adjustment mechanism

CBAM is not a static policy. Its future evolution is expected to include:

- Expansion of Scope: The inclusion of more sectors, such as chemicals, plastics, and refined petroleum products, is highly likely post-2030.

- Integration with Other Policies: CBAM will become more deeply integrated with the broader EU Green Deal framework.

- Global Proliferation: Other jurisdictions, like the UK and Canada, are already considering similar border carbon measures, which could lead to a patchwork or eventual harmonization of global carbon pricing at the border.

- Refinement of Rules: Methodologies for calculating embedded emissions, particularly for indirect emissions and complex goods, will continue to be refined.

Staying Informed

CBAM is a dynamic policy with ongoing development. Here are some resources for staying up-to-date:

EU CBAM Website: https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en

Think Tanks and Research from Organizations: CleanCarbon.ai.

Industry News Sources: Publications covering trade and carbon policy offer updated perspectives.

FAQ

Who is affected by CBAM?

EU importers of covered goods are directly responsible for compliance. Indirectly, non-EU producers and exporters of those goods to the EU are significantly affected, as the cost and reporting requirements will flow down the supply chain.

How is the price of a CBAM certificate determined?

The price is not fixed. It is based on the weekly average auction price of EU ETS allowances (EUAs), expressed in €/tonne of CO2e.

Can I get an exemption from CBAM?

There are no blanket exemptions. However, the cost of a carbon price already paid in the country of origin is fully deductible. Goods from countries fully integrated with the EU ETS (like Iceland, Liechtenstein, Norway, and Switzerland) may be excluded.

What is the difference between the EU ETS and CBAM?

The EU ETS is a cap-and-trade system for emissions from installations within the EU. carbon border adjustment mechanism is a border carbon adjustment on the embedded emissions of specific goods imported into the EU. They are designed to work together.

Where can I find official information and guidance?

The European Commission’s Directorate-General for Taxation and Customs Union (DG TAXUD) is the primary source for official CBAM documentation and guidance.