CBAM 2025 Shaping the Future of Climate- Linked Global Trade

CBAM 2025 is fleetly arising as one of the most significant policy instruments in the global fight against climate change. As countries and diligence decreasingly commit to sustainability, the Carbon Border Adjustment Mechanism is n’t just an environmental tool it’s an profitable game- changer. By conforming carbon prices at the border for certain imported goods, CBAM ensures that global trade aligns with climate pretensions and internal carbon pricing systems, leveling the playing field between domestic and transnational directors.

What's CBAM?

CBAM 2025, or the Carbon Border Adjustment Mechanism, is a corner policy espoused by the European Union to reduce carbon leakage and encourage cleaner product practices. The medium imposes a carbon price on certain goods from non-EU countries, a price that products entering the EU are required to reflect the carbon costs that original directors formerly bear under the EU Emissions Trading System (ETS).

This innovative regulation supports the EU’s ambition to reach climate impartiality by 2050. It addresses enterprises that diligence might dislocate to countries with looser environmental norms, undermining global climate sweats.

Why Was CBAM Introduced?

The core purpose of CBAM 2025 is to support global climate policy by discouraging carbon leakage where product shifts to countries with less strict emigrations norms. The medium

- Prevents illegal competition from countries with low carbon costs.

- Encourages greener product abroad.

- Supports EU diligence clinging to rigorous climate regulations.

- Fosters a global discussion on carbon responsibility.

In effect, CBAM is further than an import duty — it’s a strategy to globalize sustainable artificial metamorphosis.

How Does CBAM Work?

At its core, the Carbon Border Adjustment Mechanism operates by placing a carbon price on imported goods. The medium requires importers to buy CBAM instruments, priced also to the EU’s carbon allowance prices.

Then’s how it functions

- Tracking Emigrations Importers must declare the carbon emigrations bedded in their products.

Purchasing instruments Grounded on reported emigrations, instruments are bought to neutralize the carbon footmark. - equating the request This situations the playing field with EU- made products, which formerly internalize carbon costs.

- Over time, CBAM’s compass will expand, making it a crucial instrument in shaping low- carbon transnational trade.

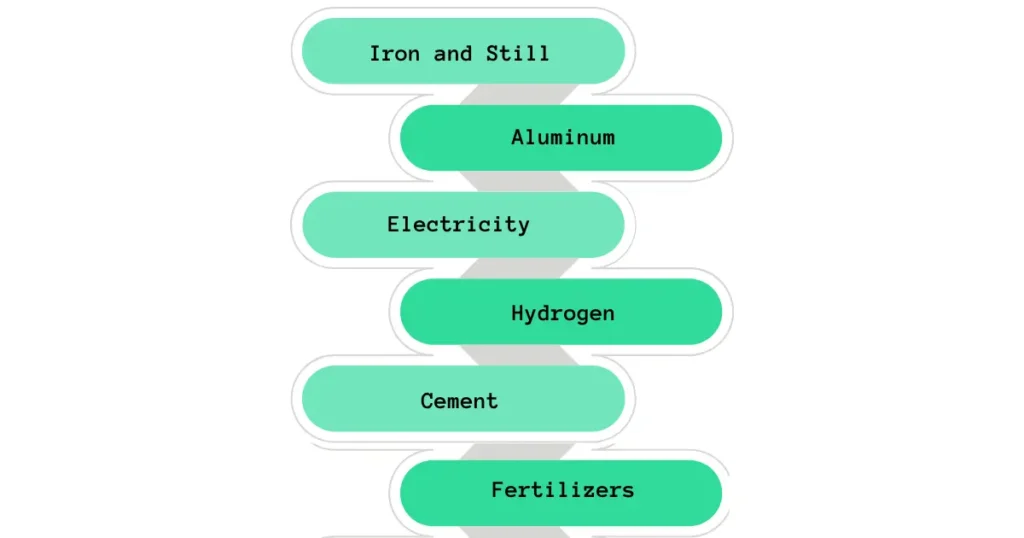

Which Sectors Are Affected?

As the medium matures, further sectors are anticipated to be included. Companies in these diligence must prepare for detailed emigrations shadowing and compliance to avoid penalties.

CBAM’s Impact on International Trade

The perpetration of cbam is reshaping trade dynamics on a global scale. Countries that export to the EU must now regard for the carbon footmark of their products. This policy

- Incentivizes clean energy Exporters are encouraged to borrow renewable energy to lower emigrations.

- Promotes translucency force chain emigrations must be bared and covered.

- Redefines competitiveness Environmental performance becomes a crucial trade standard.

Exporters from developing countries, in particular, face the binary challenge of maintaining request access while contemporizing their product processes to misbehave with the medium.

Challenges and examens of CBAM

While Carbon Border Adjustment Mechanism is hailed as a forward- allowing tool, it’s not without contestation. Some of the major examens include

- Complex perpetration Measuring carbon vestiges across global force chains is technically grueling .

- Trade Pressures Countries outside the EU view CBAM as a form of green protectionism.

- Legal query Compliance with World Trade Organization( WTO) rules is still under scrutiny.

- Developing Country Impact Nations with limited coffers may struggle to upgrade structure, risking trade loss.

These enterprises point to the need for global cooperation, specialized support, and fair perpetration mechanisms to insure Carbon Border Adjustment Mechanism serves its environmental pretensions without dismembering profitable equity.

CBAM and the Global force Chain

The global force chain is witnessing metamorphosis in response to Carbon Border Adjustment Mechanism. From raw material sourcing to finished goods manufacturing, businesses must now

- Recalculate Carbon Metrics Understanding product- position emigrations is vital.

- Redesign Logistics Favoring suppliers and routes with lower emigrations becomes strategic.

- Borrow Green Technologies Cleaner product styles reduce CBAM exposure.

The medium pushes companies to integrate sustainability into every link of their force chain, eventually promoting adaptability and responsibility in global commerce.

CBAM and Commercial Responsibility

Businesses can no longer view sustainability as voluntary. Carbon Border Adjustment Mechanism authorizations responsibility. Companies that proactively acclimatize to this change can profit by

- Enhancing brand credibility

- penetrating green backing and subventions

- perfecting functional effectiveness

- Meeting unborn nonsupervisory conditions in other requests

Sustainability, carbon reporting, and ethical sourcing are getting mainstream commercial strategies, thanks in part to mechanisms like CBAM.

CBAM A Catalyst for Innovation

While some see Carbon Border Adjustment Mechanism as a compliance chain, forward- allowing companies fete it as a motorist of invention. It creates

- request Demand for Low- Carbon Goods

- impulses for Research & Development in Green Tech

- Collaboration Between Governments and Assiduity

By prioritizing sustainability, businesses can sculpt out competitive advantages in a carbon-conscious frugality.

The Future of Carbon Border Adjustment Mechanism

Carbon Border Adjustment Mechanism isn’t stationary. As the EU refines its climate programs, the compass and structure of Carbon Border Adjustment Mechanism will evolve. unborn considerations include

- Addition of further Products

- Global Adjustment with Other Carbon requests

- Digital CBAM Reporting Systems

- hookups with Developing Countries for Capacity Building

Eventually, Carbon Border Adjustment Mechanism may inspire analogous mechanisms in the US, UK, and Asia- Pacific, creating a more invariant global approach to carbon responsibility.

Preparing for CBAM Compliance

To stay competitive, businesses need to embrace a Carbon Border Adjustment Mechanism – readiness mindset. Steps to prepare include

- Conducting Carbon Footprint Audits

- Training force Chain Partners

- Investing in Clean Energy results

- using Technology for Real- Time Tracking

- Aligning with EU Reporting norms

Failure to misbehave won’t only affect in penalties but may also lead to reputational damage and loss of request access.

Final studies CBAM as a Turning Point

CBAM represents further than just a policy it’s a signal of a new period where carbon responsibility shapes transnational trade. It places climate policy at the core of global economics, icing that no country or company can ignore its environmental liabilities.