EU CBAM reporting reaffirms that climate change has started impacting business and economy significantly across the world. Governments and people at all levels have been trying to reduce and prevent carbon emissions to push the global business community towards decarbonisation. With this vision in mind, the European Union Commission introduced the Carbon Border Adjustment Mechanism, which is in the mandatory reporting phase from January 2026.

In this blog, we will understand everything about CBAM.

What is Carbon Border Adjustment Mechanism?

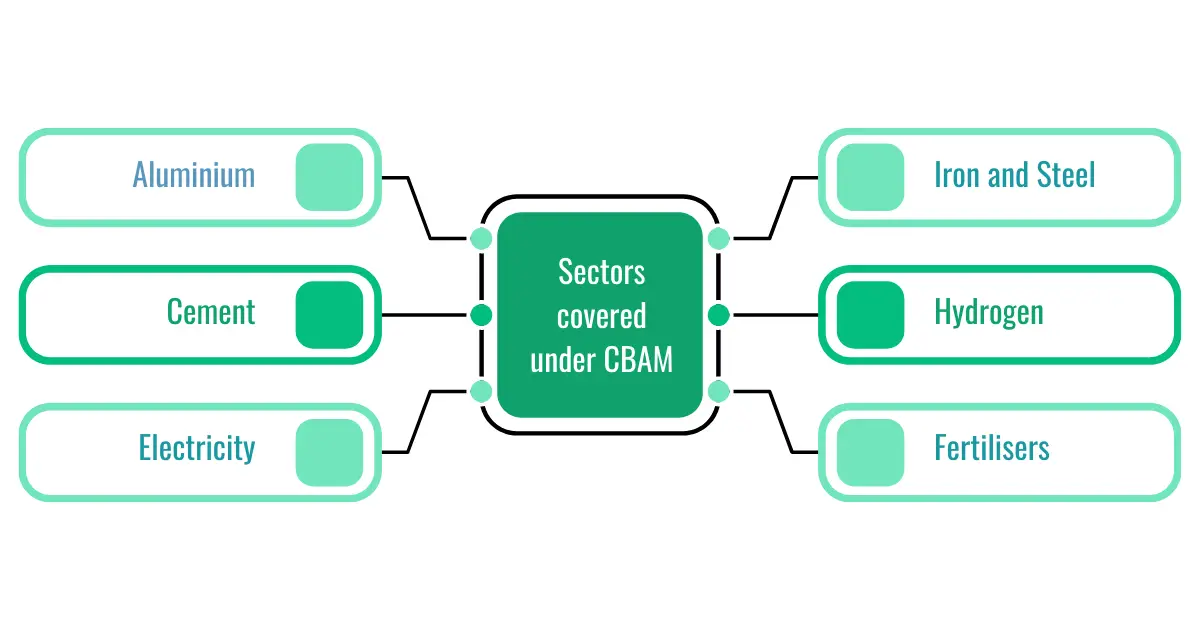

The EU Carbon Border Adjustment Mechanism is a climate tool to facilitate equal carbon pricing for all carbon-intensive products entering the European Union market. The CBAM is a kind of carbon tax or carbon import tariff imposed on goods made of Iron and Steel, Aluminium, Cement, Fertiliser, Hydrogen and Electricity.

As the pilot learning period for CBAM ended in December, 2025 and mandatory CBAM reporting began from January, 2026, the imports and suppliers must submit their accurate CBAM report on time to avoid penalty. Moreover, importers who are required to submit the embedded emissions report for their imported goods will also have to pay ‘CBAM certificate prices’ from the start of 2027. The price of these CBAM certificates or CBAM tax will depend on the amount of emissions in their products. And the pricing will be decided as per the EU ETS quarterly and weekly average auction rates.

Why was CBAM introduced?

- Prevent carbon-leakage: CBAM puts a fair price on the products’ carbon emissions that are manufactured outside the EU and are meant to enter the EU market for free circulation. In a nutshell, the CBAM’s primary aim is to prevent carbon-leakage, a situation when EU companies start shifting their production units to countries with lax climate policies to bypass the EU laws on climate.

- Create trade parity and level-playing field: Another reason for CBAM’s roll out is to create a level playing field for all traders in the EU market. As the EU has its own Emissions Trading System (ETS) to limit the carbon-intensive productions, the EU affiliated companies felt financial and business pressures.

This is because companies from non-European nations with loose and no carbon pricing mechanisms started to flood the EU market at far cheaper rates, resulting in product pricing disparity and imbalance trade. Evidently, this would have put the EU companies at a disadvantageous position. In order to eliminate this situation, the EU introduced the CBAM which is a replica of EU ETS.

- Push for global decarbonisation : The European Union commission introduced the CBAM to push for global decarbonisation and meet its own target of making the EU carbon-neutral by 2050, under its ‘Ft for 55’ initiative.

Sectors covered under CBAM

At present, the CBAM is applicable to six sectors and products that pose the greatest risk of carbon-leakage and are considered to be the most carbon-intensive: Iron and Steel, Aluminium, Cement, Fertilisers, Hydrogen, and Electricity. However, from 2030 onwards, more sectors and products under the EU ETS will most likely be covered by CBAM.

Types of Carbon Emissions needed under CBAM

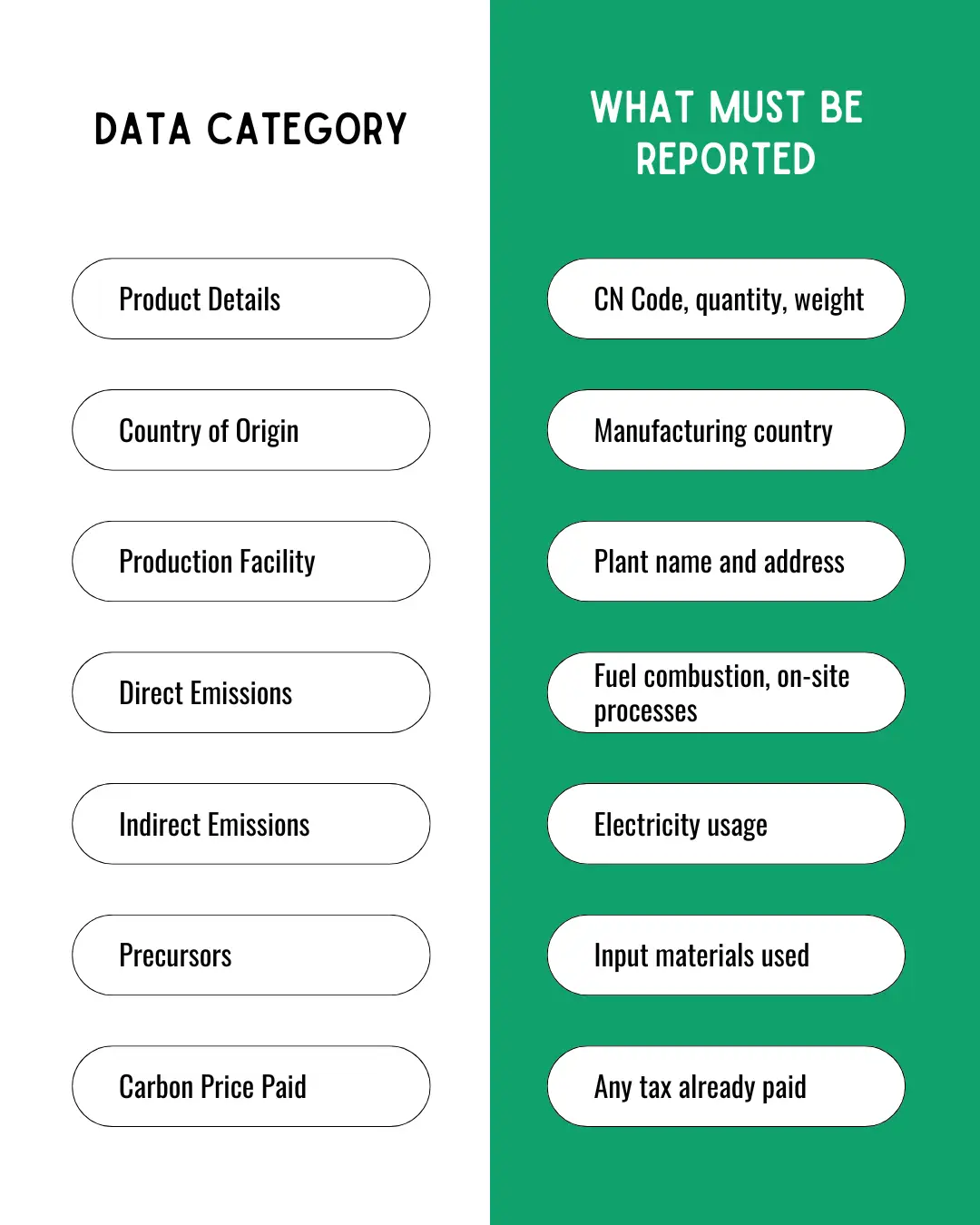

There are many types of carbon emissions covered under the CBAM reporting.

Direct Emissions: Any carbon emissions from the facility and onsite productions processes including fuel combustions are covered under the direct emissions and required under CBAM.

Indirect Emissions: CBAM’s indirect emissions cover emissions from electricity used in production — roughly Scope 2 (though actual electricity generation may be offsite).

Specific Embedded Emissions: Specific embedded emissions means specific direct emissions along with specific indirect emissions for a particular product that comes under the CBAM.

Precursors Details: Precursors are one CBAM product used to make another CBAM product after proper production processes. Under the CBAM regulation, precursors’ details or third party vendors’ details are also required.

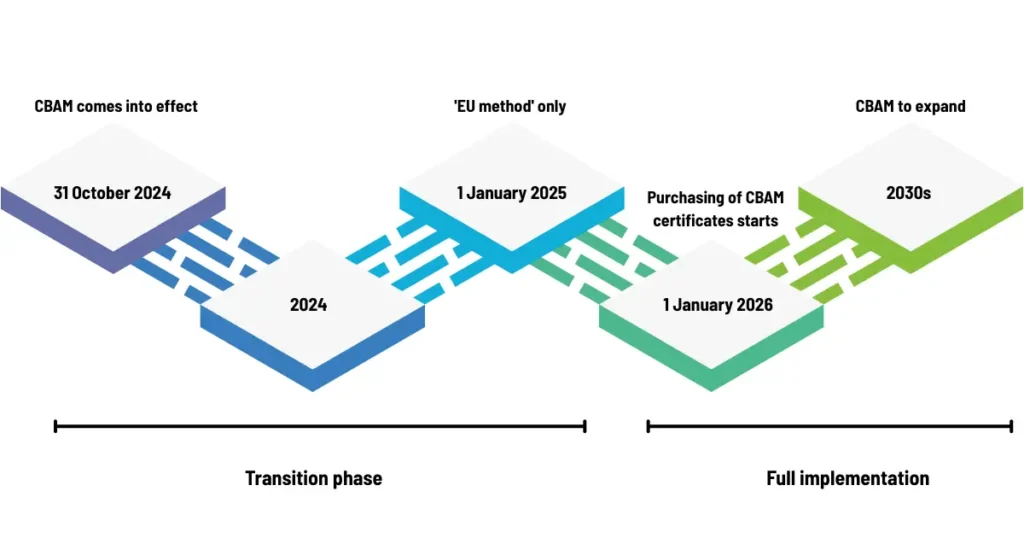

CBAM is being implemented in two phases: Transitional Phase and Definitive Phase.

Transitional Phase (October 1, 2023, to December 31, 2025): This was also known as pilot learning phase for imports and exporters to understand everything about CBAM and how to implement it. The CBAM learning period allowed all CBAM impacted industries and companies to prepare themselves for the mandatory CBAM reporting phase from January 2026. Submission of quarterly CBAM reports was the only mandatory requirement by EU importers. There was some leniency allowed during this phase until December, 2025, as CBAM was very new and highly technical regulation for all companies and suppliers.

Definitive Phase (Mandatory CBAM reporting from January 2026): After the businesses started realising CBAM reality, they have been mandated to submit their CBAM report every quarter. During the mandatory reporting phase of CBAM, importers and exporters will not be able to do business with Europe without submitting emissions data. However, if the importer can prove that a Carbon price was paid during the production of the imported products in the country of origin, then the amount equivalent to it can be deducted.

Things that change from January 2026:

- Importers must submit a quarterly CBAM report.

- Carbon tax will be calculated taking 2026 as the base year.

- EU buyers must register with the National Competent Authorities.

- Virtual and physical data verification by EU-approved verifiers.

- No use of default values, only accurate specific emissions will be acceptable.

- Penalties for late submission of CBAM report.

- Inaccurate CBAM reporting will invite financial penalties.

- No shipment will be allowed entry in the EU without a proper CBAM report.

Things that change from January 2027:

- CBAM tax payment.

- Higher emissions will lead to higher CBAM tax.

- No CBAM will mean absolutely no business with the EU.

CBAM Reporting Deadlines (2025–2027)

Who will be impacted by CBAM?

CBAM is going to impact any company that exports products made of Iron and Steel, Aluminium, and Cement. For example, a Brazilian company exporting Cement to Europe, India and China exporting Iron and Steel to Europe or Istanbul sending its steel shipment to Europe must submit their CBAM report for uninterrupted access to the market. It does not matter where your company is located if you export similar products either directly or indirectly to Europe.

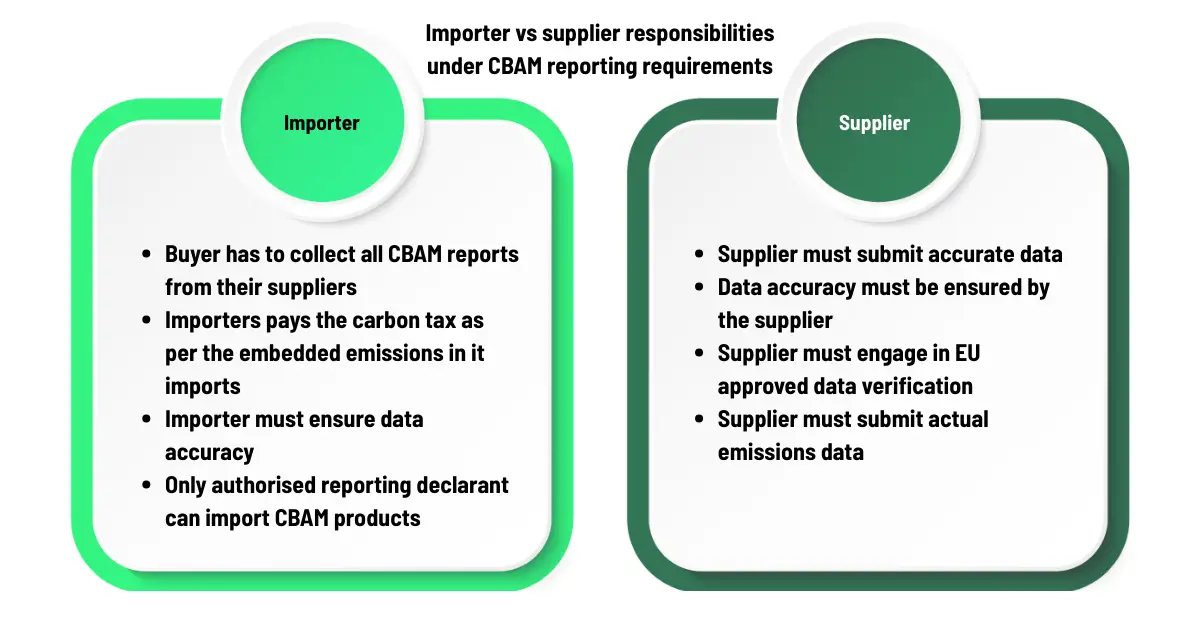

CBAM Reporting Requirements: Who submits a CBAM report?

Under the CBAM reporting requirements from January 2026, only the Authorised CBAM Declarants (ACD), also known as importers or European buyers, are mandated to submit quarterly CBAM reports to the authorities for free circulation of their imported product.

An importer which is not a legally Authorised CBAM Declarant can not accept CBAM imports for the EU market. For example, a supplier of a product made of iron and steel from India to Europe has to submit the CBAM report to its buyers quarterly. Subsequently, the buyers will submit these reports to the customs and relevant authorities in the EU to sell their products in the EU market.

In cases where the importer is not based out of the EU, its customs representative must become an ACD and take up the full legal responsibility of CBAM compliance.

Use of default values under the CBAM

Under the latest CBAM rule updates, default values have been designed to be higher than the real values to prevent carbon leakage and are aimed at reducing dependence on default values. Moreover, a mark-up is added on default values for installations having more emissions than the country average. And this inflates the CBAM tax.

The mark-ups are intended to limit the use of default values. In the case of an unknown precursor’s origin, the EU will apply the higher level of default values in the globe. Moreover, default values apply across the supply chain and use of default values for precursors can significantly increase the total embedded emissions.

What happens if data is missing

If the emissions data under the CBAM reporting requirements are missing by mistake or omitted by design, it will invite heavy penalties and increased CBAM tax. Submitting inaccurate emissions data could also mean inflated carbon tax and unwanted penalties.

What to include in a CBAM report?

The European Union Commission has published a specific CBAM report format that must be used to submit the main emission data to EU importers.

Also Read: How To Fill a CBAM Report?

How will CBAM tax be decided?

As per the latest information, CBAM tax will be calculated for quarterly reports on quarterly average auction price of EU ETS until the end of 2026. Moreover, from 2027 when the CBAM tax will be collected from importers, the EU ETS weekly average auction price will be used to determine the CBAM Certificate Prices. These are subject to changes.

Key exemptions under CBAM

There are some key exceptions under the CBAM for importers and exporters:

- EU buyers who import less than 50 tons of CBAM goods don’t have to submit the CBAM report until the end of 2025. However, this does not apply to suppliers.

- All EU imports from countries like Iceland, Norway, Liechtenstein, Switzerland are not mandated to submit CBAM reports as they are linked with the EU ETS.

- If the importer can prove that it has paid any carbon price for the imported goods in the country of origin, then that amount can be deducted or readjusted in the CBAM report.

What is the Omnibus package?

The European Union Commission published the Omnibus package on February 26, 2025 for CBAM reporting with some leniency for importers. The Omnibus package came as a relief for 1,82,000 SMEs and European buyers on submitting CBAM reports for their imports. Even in the current Omnibus package, 99 per cent of the total emissions are covered by CBAM.

The Omnibus package announced de minimis threshold for CBAM reporting by EU importers only. Any EU importer importing less than a 50-tonne mass (Goods) of any CBAM-listed products per year or 100 tonnes of CO2 every year is exempt from CBAM compliance.

This means relief for 90 per cent of the importers sitting in the EU, also part of SMEs. Once importers exceed the 50 tonnes annual limit, all imports for that year will automatically fall under the full CBAM obligations. Moreover, this will mean tax for all these years. Hence, it is important for EU buyers to review their imports to avoid any last minute hassles.

Latest changes under the CBAM

CBAM Certificate Price Calculation As Per EU ETS Auction Price

From January 1, 2026, the EU buyers are mandated to calculate their CBAM prices and purchase CBAM certificates. And importers now need to hold CBAM certificates equal to 50% of year-to-date embedded emissions at each quarter-end (earlier 80%). However, carbon price can be readjusted as importers can deduct any carbon price already paid in the country of origin — but only with certified evidence.

This means, if the supplier for a CBAM listed product has paid applicable Carbon tax in the country of origin, then the price for that can be readjusted under the CBAM provisions and the importer does not need to pay double tax. Here is a look at some major CBAM changes:

- CBAM Certificates Pricing: From January 2026, CBAM certificate price will be calculated on the basis of EU ETS average auction prices and allowances. These prices will be decided on the basis of final auction clearing price, that is the price paid by bidders for each EU ETS allowance upon closure of the bidding window in an auction.

- Clear Price Indication: The Commission will try to publish a single quarterly CBAM price from 2026 for everybody’s reference. Moreover, the Commission will make all the prices directly accessible to Authorised CBAM Declarant’s accounts.

CBAM Certificate Price Rules for 2026

- From January 2026, the Commission will calculate CBAM certificate price for each quarter as the quarterly average auction clearing prices under the EU ETS. These prices will be calculated during the first calendar week of every quarter.

- In 2026, the quarterly CBAM certificate price will be calculated.

- The relevant auction platforms shall provide all the required information for calculating the CBAM certificate prices for that quarter.

CBAM Certificate Price Rules for 2027

- From January 1, 2027, the CBAM certificate price will be calculated every calendar week on the basis of the weekly average of EU ETS allowance prices.

- Price of CBAM certificates will apply to all CBAM certificates sold to Authorised CBAM Declarants.

- The Commission will publish all CBAM certificate prices on its official website on the first working day.

- Price of CBAM certificates will be made available only to Authorised CBAM Declarants.

Regulation for Verification of Actual Embedded Emissions

Under the CBAM reporting requirements, EU-approved verification has become mandatory from January 1, 2026. Moreover, the suppliers and EU buyers must have emission-related data and verification evidence for the past 4 years since the start of the reporting year for auditing purposes. Here is a look at some major changes in the CBAM verification:

- EU-approved verifiers must conduct physical site visits at the installation where goods were manufactured.

- In 2026, physical visit at all locations is mandatory. However, from 2027, the verifier may either replace the physical visit with virtual visit or waive off the visit.

- The verifier can waive visit from 2027 only after visiting once in 2026 and it does not compromise the data credibility.

- The physical visit should be carried every two years at least.

- The verifiers must analyse all data and cross-check for any misstatements and inaccuracies in the submitted report. Moreover, the verifier has to apply a risk-based approach to reach any opinion.

- The submission and review of the verification reports will be done using a single electronic temple given by the Commission only.

- The verifiers can apply materiality threshold (Scope of error) by 5% only.

Accreditation of agency for data verification

As per the latest CBAM rules, only EU-accredited verifiers are allowed to verify the data. The accreditation rules say that the verifier can be from anywhere in the world and must be a legal entity accredited by the EU National Accreditation Body (NAB). The accreditation is given after a thorough review of the details submitted in the application. The legal entity that wants to be the accredited agency for CBAM report verification must be CBAM technical expert, must have proven expertise in tracking system boundaries, emissions types, know all about the company, have knowledge in EU ETS style emissions verification, CBAM-specific methodologies and sector rules.

For accreditation, the verifying agency must have:

- Proven technical expertise

- Expertise in CBAM methodologies

- Knowledge in emissions calculation methods

- Must know about monitoring and data control systems

- Competent team of lead verifiers

- Sector and product experts

Use of default values vs actual emissions in CBAM reporting

Default values are conservative assumptions and estimated emissions numbers that could be applicable to a particular production process. The EU has published default values for companies that can not provide the actual emissions data under the CBAM reporting requirements. These are always much higher than the actual embedded emissions values of a product or a company.

Under the CBAM reporting requirements, using default values will always mean paying more carbon tax than applicable on actual emissions. This is a deliberate design to prevent carbon leakage and discourage use of default values. Exporters and importers are allowed to use the default values from January 2026 but it could mean significant financial consequences.

Under the latest CBAM reporting rule changes, which is applicable from January 2026, the Commission has published the provisional list of default values for all major countries that export to the EU. These default values have been deliberately kept very high to use them as punitive measures and encourage importers and exporters to use actual emission values. There are different benchmarks given for different sectors and products for all the CBAM listed HSN/CN Code.

Default values and their impacts:

- Using default values could increase CBAM tax 5 times.

- Different default values for different countries.

- Extremely high default values to act as punitive measures.

- Additional mark ups of 10 % & 20% on the use of default values.

- No benefits of a low-carbon economy.

- Pressure to change suppliers due to inflated CBAM tax.

- Uncompetitive trade business.

Exporters should collect actual emissions and submit verified embedded emissions data to the buyers. Not using default values means no unwanted CBAM taxes and uninterrupted export business to the EU.

Challenges under EU CBAM

The EU CBAM is a very complex and data-hungry regulation that requires systematic changes and adoption of procedures and frameworks to ensure CBAM compliance. Here is a look at some major challenges in CBAM reporting:

Accurate data collection: CBAM is very complex regulation and requires involvement of multiple stakeholders for data collection. There are different kinds of data needed under the CBAM compliance because of different production processes and supply chain challenges for raw material procurement.

Accurate calculation: Accurate calculation is another major concern for importers and suppliers. This could impact the company financially as wrong calculations could lead to inflated prices and a disproportionate amount of CBAM tax. And manual methods are highly prone to errors and miscalculations. Hence, an effective tool is needed to ensure accurate calculation.

Data auditability: The EU is also going to verify all the emissions data submitted under the CBAM to effectively prevent attempts of carbon-leakage. Therefore, carbon emissions data auditability must be maintained. A CBAM reporting software like CleanCarbon.ai has all the advanced features to maintain the data traceability and auditability.

How CleanCarbon.ai is helping suppliers in CBAM compliance?

The EU CBAM, as we now know, is highly technical and data-consuming regulation. And it involves carbon tax on the basis of increasing embedded emissions in the imports. Hence, we need a software which has features to accurately gather carbon emissions data, analyse and predict the carbon tax with exact calculations to avoid greater financial burden on the company.

CleanCarbon.ai is CBAM-first consultancy platform that ensures end-to-end CBAM compliance. It has special features in its CBAM tool that allows live emissions tracking and studying them to facilitate EU-approved data verification, maintaining data auditability and traceability.

What is CBAM reporting?

Carbon Border Adjustment Mechanism (CBAM) is EU climate regulation meant for all exports of iron and steel, aluminium, cement. Electricity and fertilisers. CBAM reporting asks for carbon emissions data associated with the product and carbon tax is applied on them accordingly.

Will CBAM cover all categories under EU ETS?

Currently, CBAM covers six sectors like Iron and steel, Aluminium, Cement, Fertilisers, Hydrogen and Electricity.

Even if my product’s HSN code does not fall under CBAM, do I need to submit a CBAM report?

Yes, even if products don’t fall under the CBAM HSN codes, you will have to submit the CBAM report if your imported or exported goods carry components and elements from Iron and Steel, Aluminium, and Cement.

Who will decide CBAM tax? And how?

Currently, CBAM tax will be determined on the basis of EU ETS average auction prices until the Commission publishes exact thresholds for CBAM specific imports.

Is indirect emissions still covered under the CBAM?

Indirect emissions of the reporting company are covered under the CBAM but not for the precursors. Reporting indirect emissions of precursors is optional and not required. Only indirect emissions of the final product process must be reported.

Who is required to submit a CBAM report?

EU buyer (also known as importer and Authorised CBAM Declarant) is mandated to submit the CBAM report for all imports in the EU from January 2026.

What is the CBAM compliance deadline?

CBAM has become a mandatory compliance from January, 2026 for all EU-importers and exporters of carbon intensive products entering the EU. The CBAM reporting is done on a quarterly basis for the shipment sent to the EU.

What happens if CBAM reporting is late?

There will be penalties and increased CBAM taxes on importers and exporters it the CBAM compliance is not done on time.

Is CBAM reporting quarterly or annual?

Importers have to submit quarterly CBAM reports for the imported products every 3 months.

Can exporters submit CBAM reports?

The exporters submits the CBAM report to the EU importer, who further submits the CBAM report to the EU authorities.

How is CBAM tax calculated?

CBAM tax is applicable for all CBAM exports to the EU from January 2026 and it is calculated on the basis of EU ETS quarterly average auction prices. In simpler terms, CBAM tax will be a mirror image of the EU’s internal carbon tax rates.

Are default values allowed under CBAM?

Default values are allowed under the CBAM but they have been intentionally kept punitive in nature. There are different default values for different countries and products, which are extremely high.

Why do default values increase tax?

By design, the EU has kept very high default values to encourage the use of actual emissions data under the CBAM. Hence, higher default values drastically increase the taxes

Why do actual emissions reduce CBAM cost?

What happens from 2026 onward?

CBAM has become mandatory from January 2026 and anyone not submitting the CBAM report on time will not be able to do business, could face penalties, witness increased carbon taxes and also suffer shipment blockage.