The European Union Commission has announced that CBAM reporting will become mandatory from January 2026 and also published a public consultation form to strengthen CBAM reporting rules and calculation methods and price adjustment guidelines. Here is a look at the latest CBAM updates:

The European Union Commission has announced some new CBAM rules, which is going to become mandatory from January 2026. Here are the important updates on CBAM reporting rules:

European Union Confirms CBAM Becomes Mandatory from January 2026

In an official reply to the European Federation of Steel, Tubes and Metals Distribution & Trade (EUROMETAL), the European Union Commission has once again confirmed that the Carbon Border Adjustment Mechanism (CBAM) will be made mandatory from January 1, 2026 without any compromise and leniency for importers and suppliers across the globe. The significant announcement was made after EUROMETAL’s request for urgent clarification over rumors related to a possible delay in CBAM reporting, circulating in the market.

CBAM: EU Calls for Evidence on Emissions Calculation Methodology & Carbon Pricing Rules

The European Commission has launched a Call for Evidence (28 August – 25 September 2025) to gather stakeholder views on critical aspects of the Carbon Border Adjustment Mechanism (CBAM). The public consultation will address three critical areas such as methodology for calculating embedded emissions in CBAM goods, adjustment of CBAM certificates in line with EU ETS free allocations, and rules for deducting the carbon price already paid in third countries.

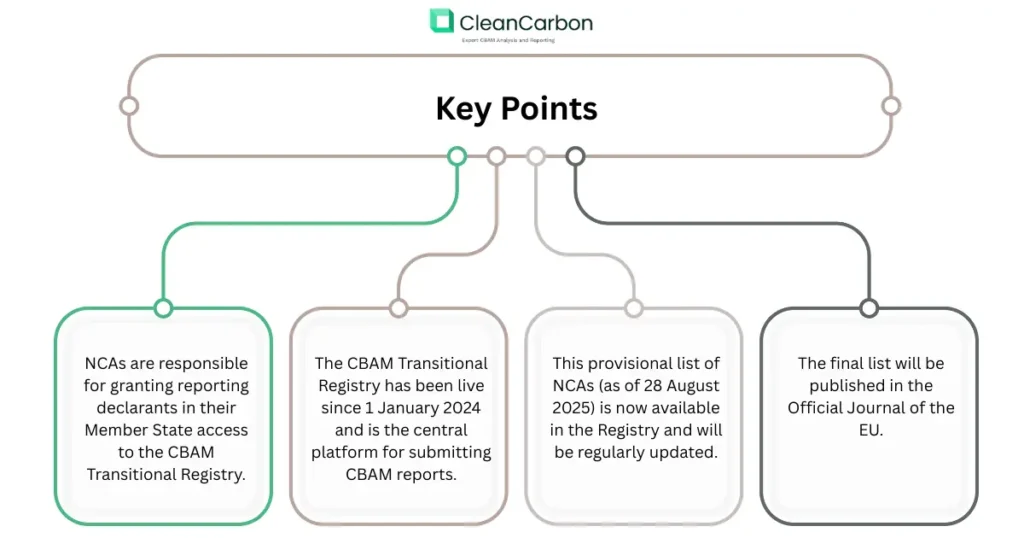

CBAM Update: EU Announces List of Competent Authorities for CBAM Reporting

The successful implementation of the EU Carbon Border Adjustment Mechanism (CBAM) depends on the active role of National Competent Authorities (NCAs) across all 27 EU Member States.

What is CBAM

The Carbon Border Adjustment Mechanism is a climate policy introduced by the European Union Commission to prevent carbon leakage, a situation where companies outsource their production to any other country with lax climate policies to evade carbon tax and decarbonisation responsibilities. The EU also introduced the CBAM to create a level playing field for all businesses and traders from across the world. The entire mechanism is a replica of the European Union Emissions Trading System (EU ETS). Currently, CBAM is applicable to six highly carbon-intensive sectors such as Iron and Steel, Cement, Aluminium, Electricity, Fertilisers and Hydrogen. Although CBAM is only applicable to six carbon-intensive sectors currently, it is expected to expand to more sectors in the future.