With manual reporting proving complex and error-prone, businesses now require dedicated digital solutions. This blog highlights the essential features of a top-tier CBAM accounting platform to ensure compliance, efficiency, and competitive advantage.

If your business imports products into the European Union, you may have come across the term CBAM—the Carbon Border Adjustment Mechanism. This is not merely another layer of EU regulation; it represents a significant transformation in the accounting of cross-border trade by directly pricing embedded carbon emissions.

The initial transitional period began in October 2023, and the first reporting deadline has already passed. Many companies learned the hard way that calculating embedded emissions is a complex, data-intensive nightmare when done manually on spreadsheets.

The question is no longer if you need a dedicated solution, but which one is right for your business. So, what should you look for in a top-tier CBAM accounting platform? Let’s break down the key features.

Key Features of a Top CBAM Accounting Platform

1. Comprehensive Data Acquisition & Supplier Management

Provide a Secure Portal: Allow your suppliers to easily input their data directly into the system, eliminating messy email chains and spreadsheet versions.

Support Multiple Methodologies: Accommodate different data quality levels (from supplier-specific to default values) as defined by CBAM.

Automate Data Requests and Reminders: Chase suppliers automatically for missing or incomplete data, saving you countless hours.

2. Accurate, Audit-Ready Calculation Engine

Automate Complex Formulas: Automatically apply the latest EU-defined formulas for calculating embedded emissions for all relevant goods (iron, steel, aluminium, electricity, hydrogen, fertilizers, and cement).

Handle Precursors: Correctly account for embedded emissions in inputs like screws made of imported steel.

Maintain a Full Audit Trail: Every data point, calculation, and adjustment must be logged and traceable for verifiers and authorities.

3. Seamless CBAM Report Generation

Auto-Populate the Official Format: Directly translate your data into the exact XML schema required by the EU.

Allow for Review and Validation: Provide a user-friendly preview of the report so you can check and validate data before submission.

Simplify Submission: Offer clear guidance or direct integration for submitting the report to the relevant CBAM authority.

4. Scenario Modeling & Cost Forecasting

Model Future Costs: Forecast the financial impact of CBAM certificates on your import costs under different carbon price scenarios.

Analyze Supplier Performance: Identify which suppliers are “carbon competitive” and which are creating financial risk for your business.

Test “What-If” Scenarios: Understand how changes in your supply chain or production methods could lower your future CBAM costs.

5. Security, Support, and Expertise

Enterprise-Grade Security: Your supply chain data is highly sensitive. The platform must have robust security protocols (like SOC 2 compliance).

Regulatory Expertise: The vendor shouldn’t just sell software; they should be experts on CBAM and committed to updating the platform as the regulation evolves through the transitional period and into full implementation in 2026.

Dedicated Support: You need access to customer success teams who can help you navigate complex data issues.

Top Contenders in the CBAM Accounting Space

While the market is still maturing, several types of players are emerging:

- Specialized Carbon Accounting Pioneers: A new wave of AI-driven platforms has emerged specifically to tackle the complexity of carbon border mechanisms. A leading example is CleanCarbon.ai, which offers a dedicated end-to-end CBAM compliance solution. Their platform is designed to automate the entire process, from data collection from suppliers using a user-friendly portal to the generation of audit-ready, EU-compliant reports. Their focus on AI and automation for complex calculation and data validation makes them a strong contender for importers looking for a specialized, modern solution.

- Enterprise ERP Giants: SAP and Oracle are building CBAM functionality directly into their enterprise resource planning systems. This is a powerful option for companies already deeply embedded in their ecosystems.

- Supply Chain Transparency Platforms: Companies like Flexport and Project44 are leveraging their deep logistics data to offer carbon accounting and CBAM reporting as an extension of their services.

- Consulting & Advisory Firms: Major firms like Deloitte, PwC, and KPMG are offering managed services and platforms, combining software with their deep regulatory advisory expertise.

There is no single “best” platform for everyone. The right choice depends on your size, IT infrastructure, and the complexity of your supply chain.

Choosing a CBAM accounting platform isn’t just about compliance; it’s a strategic business decision. The right platform will not only save you from penalties and administrative hell but will also provide the carbon intelligence you need to make smarter, more cost-effective sourcing decisions in a decarbonizing global economy.

There is no single “best” platform for everyone. The right choice depends on your size, IT infrastructure, and the complexity of your supply chain.

Choosing a CBAM accounting platform isn’t just about compliance; it’s a strategic business decision. The right platform will not only save you from penalties and administrative hell but will also provide the carbon intelligence you need to make smarter, more cost-effective sourcing decisions in a decarbonizing global economy.

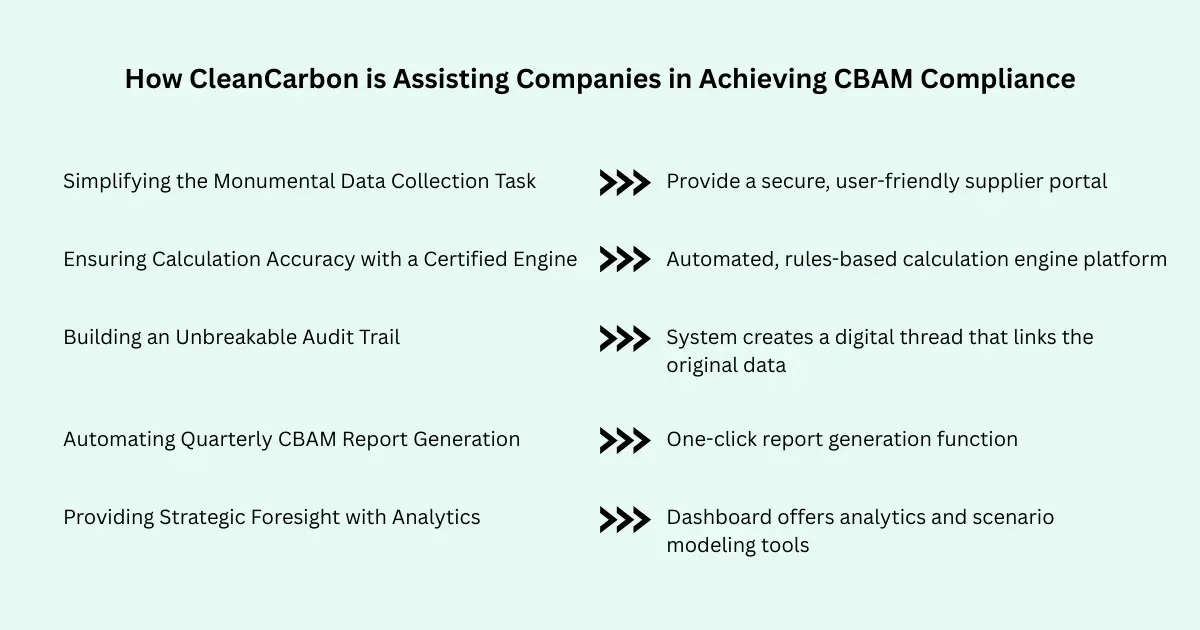

How CleanCarbon is Assisting Companies in Achieving CBAM Compliance

Achieving CBAM compliance is a multi-step process that involves data collection, complex calculations, and rigorous reporting. CleanCarbon addresses each of these challenges with a streamlined, technology-driven approach. Here’s a breakdown of how CleanCarbon guide importers to full compliance:

Why Choose CleanCabon?

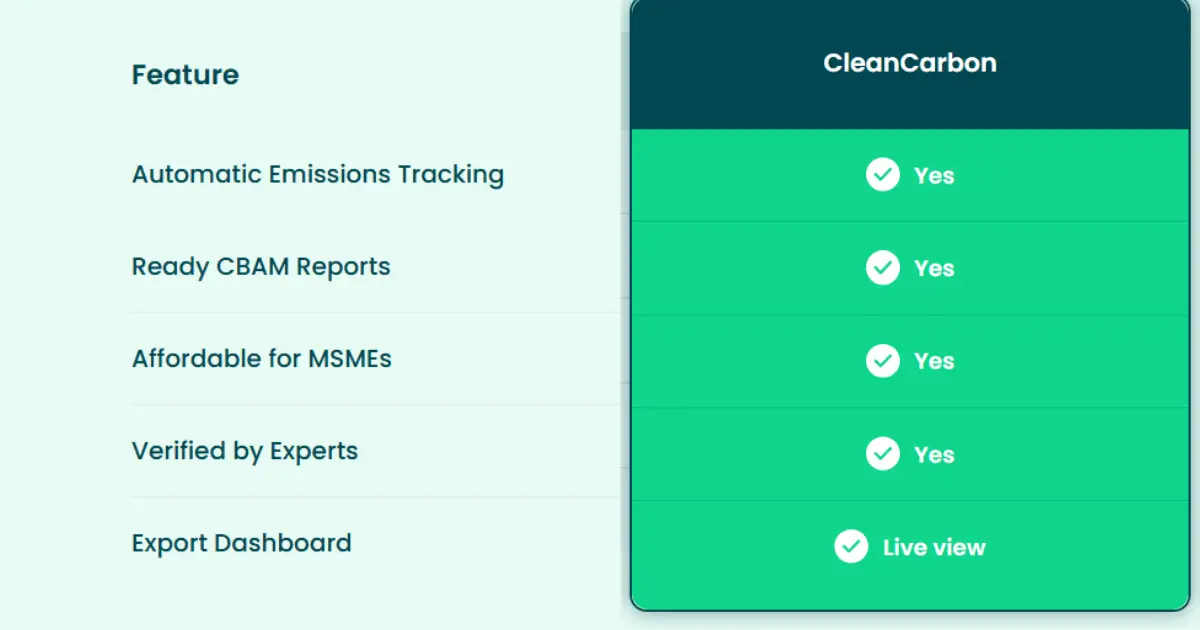

Given the growing number of options, it’s worth looking closely at what makes a specialized platform like CleanCarbon.ai stand out. For many businesses, especially those seeking a modern, dedicated solution, CleanCarbon offers compelling advantages: