- Carbon Border Adjustment Mechanism: It's an EU initiative designed to prevent "carbon leakage" and support the EU's ambitious climate goals enshrined in the European Green Deal.

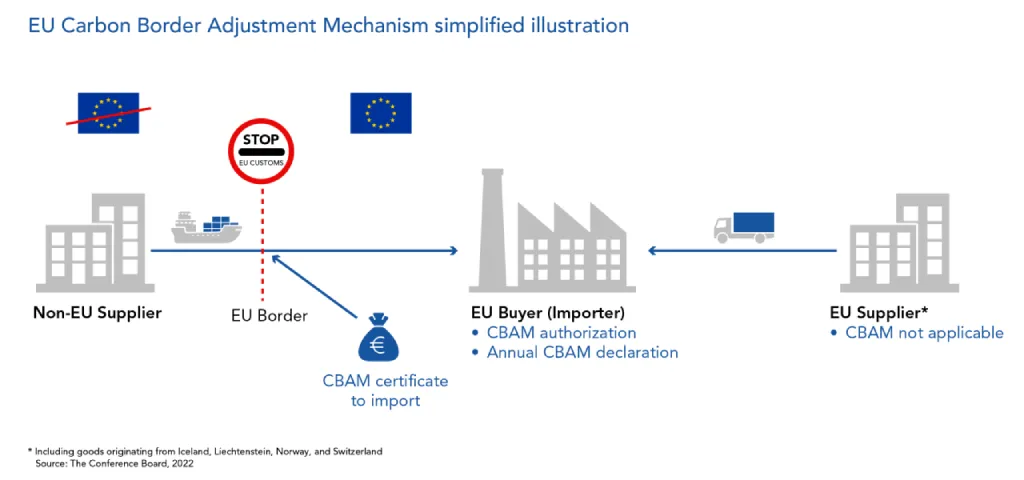

- Core Concept: CBAM essentially puts a price on the carbon emissions embedded in certain imported goods, leveling the playing field between EU producers (who already pay for carbon emissions under the EU Emissions Trading System) and importers from countries with less rigorous climate policies.

Why does CBAM matter?

- Preventing Carbon Leakage: Carbon leakage is when industries relocate to regions with weaker environmental regulations to avoid paying for carbon emissions. CBAM aims to prevent this by ensuring that emissions are accounted for, regardless of where goods are produced.

- Driving Global Decarbonization: CBAM encourages non-EU countries to adopt more ambitious climate policies and cleaner production methods to avoid the additional cost of importing to the EU market.

- Supporting EU industries: It protects EU industries that operate under strict climate regulations from unfair competition from regions with laxer environmental standards.

How does CBAM work?

- Preventing Carbon Leakage: Carbon leakage is when industries relocate to regions with weaker environmental regulations to avoid paying for carbon emissions. CBAM aims to prevent this by ensuring that emissions are accounted for, regardless of where goods are produced.

- Driving Global Decarbonization: CBAM encourages non-EU countries to adopt more ambitious climate policies and cleaner production methods to avoid the additional cost of importing to the EU market.

- Supporting EU industries: It protects EU industries that operate under strict climate regulations from unfair competition from regions with laxer environmental standards.

How does CBAM work?

- Covered Sectors: Currently, CBAM applies to iron and steel, cement, aluminum, fertilizers, electricity, and hydrogen.expand_more Certain downstream products might also be added in the future.

- Reporting Period: Starting October 2023, importers must submit quarterly reports on the embedded emissions in their covered products by the 31st of the month after the relevant quarter.

- CBAM Certificates: Importers will need to purchase CBAM certificates that reflect the difference between the carbon price in the country of origin and the higher carbon price under the EU ETS.

- Phased Approach: Initially, only reporting is required.exclamation The purchase of CBAM certificates will be phased in gradually, with full implementation expected by 2026.

Key Considerations and Debates:

- Scope: There's ongoing debate about whether to expand CBAM to cover more sectors and indirect emissions (emissions arising from the production of electricity used in manufacture).

- WTO Compatibility: CBAM must be carefully designed to comply with World Trade Organization rules, with concerns about potential trade disputes.

- Impact on Developing Countries: Some worry that CBAM could disproportionately impact developing nations that rely on exports in the covered sectors.

- Revenue Use: There is discussion about how revenue from CBAM certificates should be used (e.g., supporting climate transition in developing countries or within the EU).

Staying Informed

CBAM is a dynamic policy with ongoing development. Here are some resources for staying up-to-date:

- EU CBAM Website: https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en

- Think Tanks and Research Organizations: Research from organizations like the Center for European Policy Studies (CEPS) or Bruegel provides analysis of CBAM implementation and its impacts.

- Industry News Sources: Publications covering trade and carbon policy offer updated perspectives.